Whether you’re buying a new car or taking out a new insurance policy for an existing one, understanding what’s included in your car insurance policy can be a bit daunting.

Here at Youi, we’re all about providing car insurance that’s easier to understand, so you always know what you’re covered for. But we know life is busy, and it can be easy to skip over the small (but often very important) details – such as whether or not your car insurance covers hail damage.

Here’s what you should know about hail damage and your car insurance.

Risks of hail damage on the rise.

It’s important to note that for Australians, hail poses a very real risk – and it’s one that seems to be increasing.

The impact of climate change can already be seen across the nation, and it's only expected to worsen in the near future. Climate change plays a role in rising temperatures and bushfires, but it can also affect other weather events, including hail storms, which are expected to increase in terms of both frequency and intensity.

As well as the hail itself that can cause severe damage to your car during hail storms, strong wind and lashing rain can also have a big impact.

That's why it's more important than ever to make sure you have the necessary insurance to cover your car against hail damage. Sustaining severe damage not once, but numerous times throughout the year – or throughout a single season – is a growing risk, and can prove costly without the right cover.

Understanding hail cover.

Whether or not your policy includes hail damage car insurance will depend on the level of cover you’ve taken out, as well as if your insurer includes hail storm damage within their specific cover offering.

Let’s take a look at the different types of car insurance we offer at Youi, and which option will have you covered for hail damage. After all, no one (or their bank account) wants to be dealing with a hail damaged car that isn’t covered by insurance.

Compulsory Third Party (CTP) car insurance

Though it’s mandatory to hold CTP, it doesn’t cover hail damage. CTP covers death and personal injury to a third party, and not property damage.

Find out more about NSW CTP insurance and SA CTP insurance to discover what we cover in those states.

Third Party Property Only car insurance

Third Party Property Only car insurance covers certain third-party damage done to another car or property by the policyholder. It usually won’t cover a policyholder for the cost of repair or replacement when it comes to any damage sustained to their own vehicle. So if you’re seeking cover for hail damage, this policy type won’t do the trick.

Third Party Fire & Theft car insurance

A Third Party Fire & Theft policy is similar to Third Party Property Only, but it typically includes additional coverage for damage sustained to the policyholder’s car as a result of a fire or theft.

Although this insurance type does provide greater coverage than a Third Party Property Only policy, it does not cover hail damage.

If hail damage is a concern for you, you’ll be better served by the next policy type on this list.

Comprehensive car insurance

A Comprehensive car insurance policy suits car owners seeking the maximum level of cover available for their vehicle, as it goes above and beyond the protection afforded by Third Party Fire & Theft policies, and includes storm, hail or flood damage within the standard policy package.

Is pre-existing hail damage covered?

If your car has pre-existing hail damage, we can insure it under a Third Party Property Only policy. We won't be able to offer any other levels of cover, such as a Comprehensive car insurance policy. You'll need to have the hail damage completely repaired before we can look at providing you with a quote for Comprehensive or Third Party Fire & Theft cover.

What should I do if my car has been damaged by a hail storm?

Here’s what to do if your car has been damaged and you have Comprehensive car insurance that covers hail damage with Youi.

First of all, you can lodge your hail damage claim online or call 13 9684 to speak with one of our dedicated claims specialists.

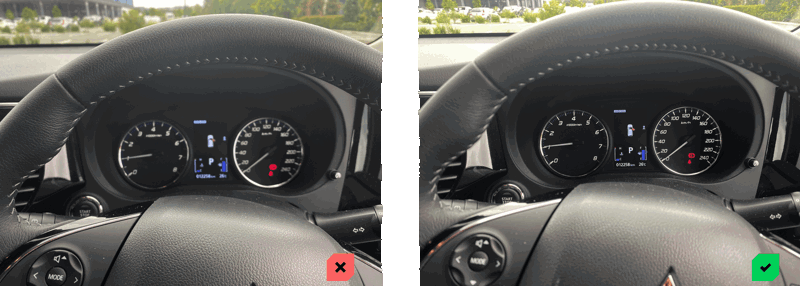

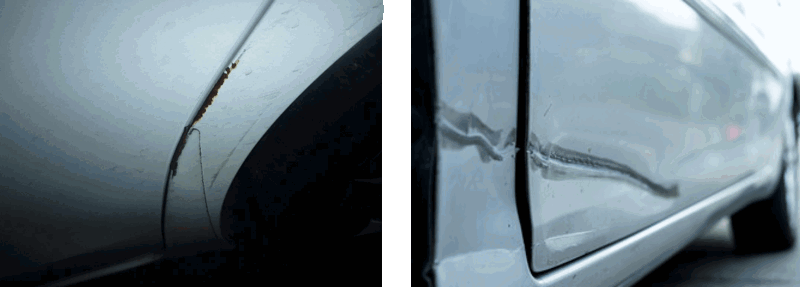

From that point, the hail damage will need to be assessed. Depending on your situation, location and the severity of damage, we’ll either organise for you to take your car into an assessment centre, or we’ll get you to send us photos. That way, we can assess the hail damage to your car and keep your policy claim moving along.

You can send us your photos either by using the Claims Tracker tool or via email.

Claims Tracker – Log in at youi.com.au/claiming and look for the ‘track your claim’ button. Each photo can be up to a maximum of 25MB.

Email – Send your photos to assessing@youi.com making sure to include your claim number in the subject line. Each email can be a maximum of 15MB, so you may need to send photos across multiple emails.

Take a look at the following steps and examples to get an idea of the types of photos we need you to take so we can assess your car’s hail damage.

Be sure to capture all four corners of your vehicle.

How can I protect my car from hail damage?

Here’s some things you can do if a hail storm is expected in your area, so you’ve got a better chance of reducing hail damage to your car.

• Keep an eye on the weather forecasts for storm warnings in your region.

• If it’s forecast to hail storm, move your vehicle under shelter or cover it with a tarpaulin. You could also invest in a hail protection cover for your car, but be sure to practice putting it on before the storm comes. You don’t want to be trying to get it sorted for the first time in the hail!

• Before the hail storm, avoid driving unless absolutely necessary. During the hail storm, don’t drive at all.

• Make sure your vehicle is properly insured and protected in the event it’s damaged by a hail storm. Repairing hail damaged cars can be difficult and expensive, so consider taking out a policy that includes cover for hail damage with a good insurer to make sure you’re not left with a huge headache.

Review your car insurance policy to make sure it includes cover for hail damage.

Does this sound familiar? You take out insurance, then set the policy aside, only to forget about it until you need to make a claim.

Familiar as it might be, treating your insurance this way can lead to unpleasant surprises if (or when) an incident occurs. So it pays to review your policy regularly, and to make it a priority to alert your insurance provider of any changes to ensure you’re still fully covered for things like hail damage.

Many drivers fail to update their policy for their current needs until it’s too late. Review your policies anytime they're coming up for renewal, or anytime you have a significant change in circumstances that could impact your policy.

Need help understanding your current cover with Youi or have further questions on protecting your vehicle against hail damage? The car insurance specialists at Youi are happy to take a look. Contact us today to see how we can help.

Youi car insurance FAQs

We can insure your car under a Third Party Property Only policy if it has pre-existing hail damage. We won't be able to offer any other levels of cover, such as a Comprehensive car insurance policy. Before we can look at providing you with a quote for Comprehensive or Third Party Fire & Theft cover, you'll need to have the hail damage completely repaired.

Yes. You’ll generally have to pay an excess on your insurance, which is the first amount that must be paid in relation to approved claims. This excess amount will depend on what you agreed to pay when you first took out your comprehensive car insurance policy that includes hail damage.

When you first purchased your policy, you may have chosen a low excess. However, this will mean you’ve likely been paying higher car insurance premiums throughout the policy period. Basically, the more money you agree upon as your up-front excess, the less your insurance premiums will be.

If your car has experienced hail damage, you can lodge your hail damage claim with one of our dedicated claims specialists on the Youi website. Alternatively, you can request a call from us or get in touch with us straight away via phone.

If you’re caught in a hail storm while driving, here are a few things that are worth keeping in mind:

- Turn on your lights to boost visibility. If visibility is severely reduced, pull off the road away from other traffic to be as safe as possible. If you pull over, turn on your hazard lights.

- Don’t park or take shelter under trees. This can be dangerous during hail storms.

- Find cover in a garage, awning or undercover car park if possible.

- If you happen to have any blankets in your car and it’s safe enough to step outside, put the blankets on top of your car to reduce any potential hail damage.

- Don’t ever drive into water flowing over roads. You never know how deep it will be, and even shallow water can sweep cars away.

- Avoid mud, debris, damaged roads and fallen trees. Also, stay away from any fallen power lines – you should always assume that they’re live and have the potential to electrocute you.

Information provided in this article includes advertising about Youi products, is general advice only and has been prepared without taking into account any person’s objectives, financial situation or needs. Consider our car insurance Product Disclosure Statement to decide if our products are appropriate for you.